Well that was an interesting week!

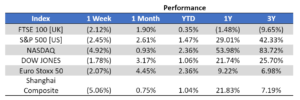

Headline equity numbers for the week just aren’t pretty:

So what happened this week?

In short, the market was a victim of its own success.

Over the last 6 months or so we have seen market interest rates trend higher in the background with the market not giving it too much attention, this is particularly visible in the US where they hit their all time low back in Mid-August at 0.5%. Then… BOOM… this last week, interest rates were the key focus of the market and they hit their 1 year high at 1.6%!

Why are interest rates moving higher? Because we are excited about the world returning to normal! Over the last few months headlines have been increasingly positive with lots of focus on vaccinations and life ‘returning to normal’. If the world returns to a more historic norm, then markets view a signal like this from two different perspectives: growth and inflation. These are both crucial and have a number of different repercussions on the market.

One big impact of these positives is the US Central Bank (‘the Fed’) being restricted in what they can and can’t do! [Last year on the crucial date of March 15th, the Fed made an emergency announcement where they cut the central bank rate to 0% and announced a program to buy $700 billion of US government bonds! An astronomical amount yet still not enough so the stocks fell pretty sharply on Monday. Then on March 23rd the Fed came back and announced that they would buy US government bonds ‘in the amount needed,’ to support the market. An open-ended commitment to buy bonds was exactly what the scale of support the market wanted to hear and that’s what it got.] These sorts of Fed orders work well to support the market in times of need but it’s still necessary to make sure they are the right measures for the longer term. The only way you achieve that is by stopping these purchases as and when things don’t look as perilous – effectively the Fed needs to reload its gun ready for the market’s next catastrophic sell-off.

The Fed hasn’t stopped its purchases yet and there has been no official indication that this is even going to happen in 2021, but investors are always trying to think a step ahead! So in the last few weeks we have seen government bond investors selling good portions of their holdings – which has subsequently weighed on bond prices and this has resulted in higher interest rates.

This past week, markets all around the world have been increasingly more sensitive to bond price and interest rate movements – more so than normal given the broader market’s sensitivity to news on either at the moment. As the US interest rate has increased, the market has changed. The amazing, wonderful, and sexy growth stocks from last year have had more questions to answer about their valuations especially as interest rates have pushed higher. This is because the profit we are expecting them to eventually make in 5 years time is being discounted at a higher rate. When the discount rate increases it leads to potentially big reductions in the net present values, which in turn leads to a significant share price revaluation. This has led to people questioning how much money these stocks are going to make and when is it going to materialise? This has been a reason that growth stocks have struggled to keep pushing higher but on the other side value stocks have gained ground so as a ‘whole’ the stock market has continued to look good and they have continued to make new higher highs! Admittedly this has all been helped by some great earning numbers over the last few weeks.

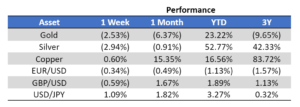

While the stock market has been climaxing, bond prices have been trending lower. This led to questions about what the Fed might do next, and when. Will the Fed stop buying treasuries? If they stop, who will buy them? If they continue, will they buy enough? All of these unanswered questions have made people nervous – too many unknowns and therefore people want to step away. amplify the move up. All of these concerns, questions, worries, and uncertainties weighed on markets this past week, going well beyond pressure on equities to hit commodities, FOREX, and cryptocurrencies too.

What comes next? WIll US government bonds continue the sell-off? Do central banks come out fighting with positive comments to shore up confidence? On Friday, the Reserve Bank of Australia launched a surprise bond-buying operation. This helped to provide some calm to the market, but will it be enough and will other central banks follow suit?

Some investors are suggesting this push higher in interest rates should bring out some potential buyers who will hold them for longer time periods because they look more attractive now. It is worth noting though that the 10-year Treasury yield on Thursday was the same as the S&P 500’s forward dividend yield. This marks the first time this has happened in almost 18 months and should make US treasuries attractive for many more people than before.

Have a good week ahead!